Governance Logistics Improvements

Authors: Uniswap Accountability Committee

Jordan Karstadt @DonOfDAOS | Abdullah Umar @AbdullahUmar | PGov @Juanbug | Alice Corsini @alicecorsini | Doo Wan Nam @Doo_StableLab

The following document, presented by the UAC, outlines a set of potential issues within the DAO’s structure and logistics, alongside proposed solutions contributed by various community members. Its purpose is not to prescribe definitive problem statements or dictate an exact set of solutions but rather to initiate a collaborative dialogue.

Through this conversation, we aim to:

(1) validate which problems are most urgent and widely recognized, and

(2) identify a problem-solution pairing (whether from the options below or new suggestions) that can be formalized into a single votable proposal. While the contents reflect the UAC’s preliminary perspectives, the final proposal may incorporate some, all, or none of the issues and solutions outlined here, depending on the feedback received from the DAO.

I. Quorum

Declining Turnout and Proposal Margin:

The Uniswap DAO requires a quorum of 40 million UNI for an on-chain proposal to pass. Since the DAO’s inception, however, token-denominated voter turnout has steadily declined from an average of nearly 60 million UNI in its early years to approximately 45 million today.

One way to highlight this trend is by tracking the quorum margin, defined as the percentage by which total votes exceeded the 40M quorum threshold. This metric offers a clear view of the DAO’s diminishing participation over time. Note that the current state of margin, 11.80% or 4.72M UNI (44.72M Total), is well below other DAOs and increasingly alarming. For instance, Arbitrum’s non-constitutional proposal quorum margin presently sits around 35% (~120M quorum threshold, or $54M @ $0.45/ARB).

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Margin (%) | 79.38% | 51.94% | 20.47% | 14.14% | 11.80% |

| Margin (UNI) | 31.75 | 20.78 | 8.91M | 5.66M | 4.72M |

This decline in participation stems from a range of factors, including general voter fatigue and limited direct voting from major institutional actors such as Consensys, Variant, and A16Z. Regardless of the cause, the implications are worth noting.

The risk of failing to meet quorum is both well-recognized and increasingly apparent. In 2025 alone, 6 out of 13 proposals (46%) passed with a margin of less than 10% above the quorum threshold. Eleven proposals (85%) cleared quorum by less than 20%, while only 2 proposals (15%) exceeded a 20% margin. These figures underscore just how narrow the participation buffer has become, placing even widely supported proposals at risk of failure.

Heavy Reliance on a Small Subset of Voters:

Beyond simply understanding how close to the margin of proposal failure we effectively always come, it is important to also recognize how few delegates make up the marginal surplus we achieve. In 2025, only 3 proposals (23%) passed without facing any quorum risk. The remaining 10 proposals (77%) were meaningfully exposed, with their success dependent on the continued participation of a small subset of highly active delegates. This concentration poses both systemic and operational risks to the DAO’s long-term resilience.

The burden of governance increasingly falls on a shrinking set of active delegates, raising concerns of overexertion and over-reliance, consolidated around a small cohort of ~13 delegates. In any given proposal, there are approximately 13 ‘meaningful votes.’ In 2 of the last 13 proposals, the absence of just one of these top 13 delegates would have resulted in a failure to meet quorum. In 3 cases, a single absentee from a top-3 voter would have blocked the proposal. And in 5 proposals, any two of the top delegates refraining would have jeopardized quorum.

In effect, the DAO operates under an unspoken dependency: nearly all of its top delegates must participate in every vote, without exception. Put plainly, the exit of even a single large voter could bring governance to a standstill. As a result of the issues, already, proposals with broad community support increasingly risk failure to reach quorum, resulting in governance gridlock.

Recent Example

This is evidenced by the recent Scaling V4 and Supporting Unichain proposal.

Last month’s Scaling V4 and Supporting Unichain proposal passed with just 41.28M UNI in favor, barely clearing quorum. Notably, 12 of the top 13 delegates voted FOR, and the margin was so narrow that had any single one of them abstained, the proposal would have failed. This outcome highlights a critical concentration dynamic. Outside this top tier, delegate influence drops off steeply:

- The 14th-largest delegate holds just 1.25M UNI

- The next 4 combined hold fewer than 2M UNI

- The next 4 after that fall below 1M, and

- The following 4 hold under 100K UNI total.

In effect, a small cohort of large delegates is carrying quorum. Without their full participation, even well-supported proposals risk failure, raising both governance fragility and resilience concerns. As an additional note, 6 of these 12 lost 2.5M UNI in delegations each, which is addressed later in this post.

| Delegate | UNI | Vote |

|---|---|---|

| Gauntlet | 5.25M | FOR |

| Teemulaumhonkasalo.eth | 5.0M | FOR |

| Michigan Blockchain | 3.86M | FOR |

| MonetSupply | 3.3M | FOR |

| FranklinDAO | 3M | AGAINST |

| Wintermute Governance | 2.75M | FOR |

| StableLab | 2.5M | FOR |

| PGov | 2.5M | FOR |

| she256.eth | 2.5M | FOR |

| 404 Gov | 2.5M | FOR |

| Avantgarde | 2.5M | FOR |

| BEN | 2.5M | FOR |

| Blockchain at Columbia | 2.5M | FOR |

| Cal Blockchain | 1.25M | FOR |

| Following 4 Delegates | <2M | |

| Following 4 Delegates | <1M | |

| Following 4 Delegates | <100K | |

| Following 4 Delegates | <15K |

Lost Voting Power

The risk of delegate removal from the voter body is not hypothetical; we’ve already seen this dynamic unfold as some institutional actors have scaled back participation due to various reasons, some, such as Consensys, citing a response to regulatory pressures.

Incidentally, between June 10-11, a16z retracted over 20M UNI worth of delegations in a single instance from various delegates. It is to be determined if these delegations will be reinstated.

Below is a list of some of the example delegation removals. Many of these entities have been important for attaining quorum over the past handful of years.

| Delegate | Voting Power Lost (UNI) |

|---|---|

| Michigan Blockchain | -2,499,999.9 |

| she256.eth | -2,499,999.9 |

| Blockchain at Columbia | -2,499,999.9 |

| Avantgarde | -2,499,999.9 |

| CalBlockchain | -1,249,999.9 |

| Chicago DAO | -999,999.9 |

| FranklinDAO | -2,499,999.9 |

| Stanford Blockchain | -2,499,999.9 |

But in any case, given the DAO passes quorum by a margin of less than 5M UNI, a single entity retaining complete and unilateral authority over nearly 50% of the entire votable supply will always remain a risk to the functionality of the DAO.

In fact, if this loss of delegate participation weren’t offset by treasury delegations, the DAO would be effectively immobile today. This was well highlighted by Tane’s work, which noted at the time of writing, that:

As well as the work of StableLab, which stated:

A small note of consideration: is the post-pass incentive decline. Once a proposal has crossed the 40M quorum threshold, there is a large step function decline in the necessity of any delegate who has not yet voted to vote. This could account for some, but not all, of the quorum margin issues and doesn’t explain the consistent decline in participation over time.

II. Voter Accessibility

Beyond issues of Quorum, there are a number of limitations when it comes to general voter accessibility in particular along the lines of proposal publication and general delegation distributions.

As background context on the two core levers of DAO governance, Quorum and Proposal Threshold, we can look to the work of @AbdullahUmar and @DAOstrat.C in 2023:

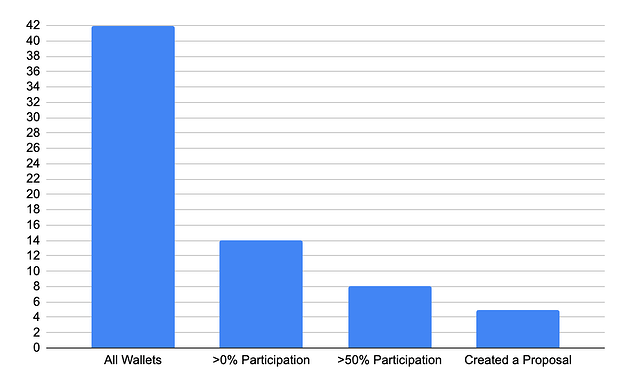

With the current PT of 1M UNI 42 individual wallets are capable of publishing a proposal. Of those 42, just 14 have ever voted even a single time. Of those 14, only 8 have voted more than half the time (much of the drop-offs here have gone silent as of recently). And, finally, of the 8 who have 1M UNI or more UNI and maintain a semi-reliable to reliable voting history, just 5 have ever published a proposal before.

Programs to Enhance Governance

With all the above problem statements in mind, the UAC has compiled a list of potential solutions crowdsourced from the community. It is important to restate that the end state solution will likely be a composition of several of the following initiatives.

I. Community Proposal Factory (CPF)

The Community Proposal Factory is a solution created by Getty from GFX, which was originally shared with the DAO in March of 2023.

The CPF effectively operates as a more accessible sub-DAO under the broader Uniswap DAO. While governed by the same voter base, the CPF would feature a significantly lower proposal threshold, making it substantially easier for individual community members to publish proposals without having 1M votes.Once a proposal meets this lower threshold, the CPF uses the same voting process as the main DAO. If the proposal reaches quorum (e.g., 10M UNI in participation), the CPF contract, holding a standing delegation of 1M UNI, is empowered to push the now-approved proposal into the main DAO. Once published on the main DAO, it functions identically to any other onchain proposal.

Requirements:

For this system to function, the CPF must hold sufficient delegated voting power to meet the main DAO’s 1M UNI proposal threshold.

Alternative Governance Track:

Many proposals in the past have relied on “sponsors” to carry a proposal through the necessary governance rails. Before v3 deployment, proposals started following an optimistic approval process, for example, a sponsor entity would be designated during the RFC phase of a proposal.

For other proposals, entities have relied on the Uniswap Foundation to post proposals—the UF was given 2.5M votes for posting proposals in Q3 2022, which it often delegates to wallets with insufficient votes.

With the introduction of the CPF, the process for proposal sponsorship can be made more community-driven. Operationally, one way to facilitate this process would be to indicate on initial RFCs what method of sponsorship the proposer intends to follow. For example:

- Proposal Sponsor: Uniswap Foundation, Michigan Blockchain, PGov, etc.

or…

- Proposal Sponsor: Community Proposal Factory

If an RFC is intended to be sponsored by another delegate, the governance pathway can be deemed the “Traditional Governance Track.”

Additional Consideration:

Once a CPF vote passes by reaching a given quorum threshold—say, 10M Yes votes, like a regular temperature check—an onchain vote would automatically be triggered based on the time-based specifications outlined in the CPF proposal. This is yet another variable worth discussing. How long after the passing of the CPF should the onchain vote be triggered? Should this time period be adjustable—if so, to what extent? Or should there simply be a queue where passed CPF proposals can one-by-one be pushed onchain? In this case, only when the passed CPF is desired to be sent onchain can it be submitted.

Limitations:

- Single Proposal Handling: A clear limitation is that the CPF can only push one proposal to the main DAO at a time. If multiple were to pass, we would need to structure a method of sequential publication to the main DAO. Or, if the bottleneck is prevalent enough, we can consider creating a second CPF.

- Hard Coding and Price / Metric Variations: Another limitation with the CPF is that there would be no option to adjust budget amounts between the CPF vote and the onchain proposal publication, as the CPF variables are hardcoded, remaining the same from the CPF vote to the onchain vote. As a result, if there is a price shift during the five days of the CPF vote, this could not be accounted for. However, this issue is largely addressed through the management of the UAC which is already well equipped to manage and rectify dollar-value discrepancies resulting from UNI price changes.

UI:

As for where the CPF interface would lie, it may be worth consulting Tally on this topic. A secondary tab on the UNI Tally page could allow for proposers and voters to participate in the CPF process.

Discussion Hosting:

In the original CPF thread, Stanford Blockchain asked where discussions would be held. To address this, the UAC recommends creating a standard proposal thread for all CPF proposals, which would then simply, and naturally, evolve into a main-DAO conversation should it pass CPF. Further discussions here are also needed.

Costs:

The GFX team would likely request a $30,000 one time payment for the creation of the first CPF.

Configuration 1 – Proposal Threshold (PT): 100 UNI:

The core intent of the CPF is twofold:

- Reduce Spam: by absorbing and offsetting any risk of potential spam due to lower PT on the primary DAO to the sub-dao

- Increase Accessibility: by maximizing community access to proposal creation to expand the collective cognition and general inclusivity of the DAO.

With those core notions in mind, it is safe to assume that the PT for the sub-DAO can be rather low

Because of these two core functions, the PT can and should be fairly low. Low enough to afford nearly all community members easy access to governance contribution, absent a major proposal champion.

Configuration 2 – Delegated Amount: 10M UNI

The delegated sum of UNI must necessarily exceed the main-DAO proposal threshold (1M UNI). However, if the treasury were to delegate a greater sum, this would propagate a secondary benefit of CPFs, an increase in votable supply. This would be completely community-owned and governed by the existing delegates, and therefore a rather agreeable place to allocate treasury-sourced voting power. To this end, 10M seems like a reasonable starting point for the discussion given the current state of quorum and votable supply.

II. Incentivized Delegation Vaults (IDVs): Increase Votable Supply

TL;DR:

Event Horizon’s Incentivized Delegation Vaults (IDVs) offer a low-friction, near-zero-effort mechanism for Uniswap to incentivize meaningful governance participation by routing delegations toward reputable delegates. It requires no contract engagement or transfer of assets on the part of the token holder.

Under this model, select delegates receive branded delegation vaults, and retail UNI holders earn weekly airdropped rewards by delegating to these vaults. There are no contract interactions, lockups, or capital transfers—delegated assets remain entirely in the holder’s wallet, preserving full liquidity and control.

This creates strong incentive alignment: UNI holders gain passive yield by participating in governance via delegation, while Uniswap DAO benefits from greater votable supply and increased participation by informed actors. With UNI currently offering 0% native yield, IDVs position delegation as a viable form of rewards for token holders. That said, if future yield avenues become available, IDVs are fully composable and can generally integrate with, and serve as yield over and above, alternative yield sources.

Mechanism:

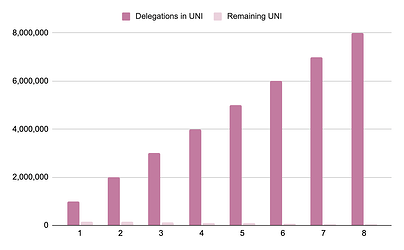

IDVs function similarly to LP yield farms and can be thought of as Merkl.xyz for token delegations. IDVs simply track delegation activity onchain, specifically who delegated to whom and how much, and emit weekly airdropped token rewards to participants. There is no transfer of assets, depositing or contract interactions necessary for claims. Rewards are distributed pro rata based on the dollar value of each user’s delegation. For instance, if 10 users each delegate $10 worth of UNI, each would receive 10% of the total emissions that week.

Security:

Tokens never leave the users’ wallets. Delegation through IDVs is fully non-custodial. Users maintain complete control over their assets and are rewarded solely for delegating, not for transferring or locking tokens. Delegation is executed via a signature-based function call on the Uniswap token contract. No contract interactions are required from the user beyond the initial delegation. Weekly rewards are airdropped directly to delegators’ wallets.

UI:

This UI is currently hosted by Event Horizon, but it can easily be integrated into Uniswap, Oku, Tally, or any other relevant or combination of relevant destinations. An ideal end solution would be the establishment of a unified governance super dash established through the partnership of several current service providers.

Delegation Sourcing:

IDVs are designed to source delegations from retail and institutional token holders, not from the DAO treasury. The primary competition, or detriment, for votable supply today comes from centralized exchanges as they vie for AUM. If users perceive that platforms like Coinbase offer superior liquidity, convenience, and security, without any economic downside, they have little incentive to move assets into self-custody or participate in governance. As a result, votable supply stagnates, weakening DAO decision-making. However, centralized exchanges currently offer no yield on governance tokens. With even a modest economic incentive, IDVs can effectively coax tokens off-exchange and into active delegation. Further, EH is actively speaking with, and seeking more, CEX and wallet service providers to offer IDTs as a white-labeled, bolt-on “earn” solution. This greatly expands potential capture.

Yield Sourcing: The initial yield for IDVs could be bootstrapped through treasury funding to activate idle governance supply. Given that UNI currently has no native yield or delegation incentives, the capital efficiency of this approach can prove to be high; even a modest APR can drive significant behavioral change. In this context, a 1% or sub-1% APR is likely to be market-acceptable, especially when paired with the zero-custody, low-friction design of IDVs. The absence of alternative yield opportunities positions delegation as the only viable source of passive return on held UNI, making the incentive disproportionately effective relative to cost. The clear downside of this model is that it does in fact take UNI emissions to bootstrap. However, if the DAO earns yield through more robust treasury management in the future, it could deviate some capital to this program. Plus, delegations often remain sticky. Once a wallet delegates to a voter, the voting power often remains sticky. Bootstrapping the delegation is often the hardest part.

Cost:

Event Horizon generally assumes a service provider fee as percentage of total emissions varying in size based upon total emission amount (higher emissions, lower percent).

Future Composability (strictly optional):

While the initial version of IDVs is fully non-custodial and non-revenue-generating, Event Horizon is actively developing an architecture that leverages delta-neutral strategies to generate managed yield. This more advanced model will adopt a true vault structure, with ongoing integrations and collaborations involving Nucleus, HyperLiquid, GMX, and others.

III. Treasury Delegation

Thus far, treasury delegations have been imperative to the functioning of the DAO.

From a proposal publication perspective, of the 5 reliable proposal publishers, 4 were delegates who received the majority of their delegations from the Underrepresented Delegates Treasury Delegation.

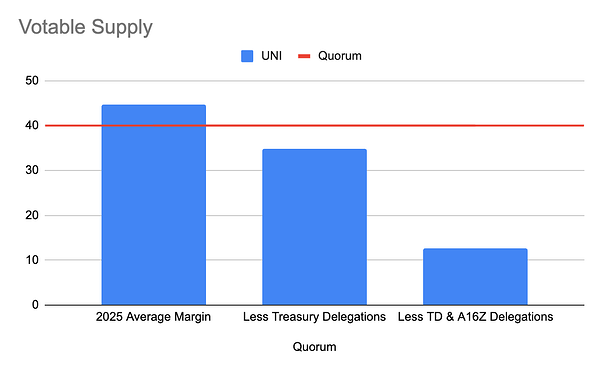

From a general quorum perspective, the 10M in delegations from the treasury is rather important to the achievement of quorum, given the current average token participation of 44.72M affords a narrow pass margin of just 4.72M UNI. Without the treasury delegations, the average token participation would drop to 34.72M UNI, amounting to a 5.28M UNI deficit. Worse yet, with the reduction in A16Z delegations, we could see a further 22M UNI reduction to 12.72M UNI for a total deficit of 27.28M UNI beneath quorum on average.

Under worst-case conditions, only 4 proposals in the history of Uniswap would have passed, and all four would have been in 2022 or 2021 when token participation was at its highest.

As such, it is fairly clear that a continuation proposal of the treasury delegation program, like proposed by Tane, would be quite valuable to the durability of the DAO. Further, an expansion of the delegation amount to include not just more total delegated amount, but also more delegates, is a worthwhile consideration.

Configuration:

Ultimately, the end state configuration of such a program is completely contingent upon the discourse and will of the DAO. To begin this conversation, the UAC identified the key configuration variable for consideration and deliberated upon generally reasonable starting points for further iteration on each.

- Total Delegation Amount: 10M UNI

- Relationship to Treasury Delegation Round 1: Additive

A subsequent treasury delegation round would not impact the existence of the current treasury delegation round. As such, added delegations through a TD Round 2 would be additive to the existing treasury delegations. As such, should the above 10M suggestion be accepted the final sum of treasury delegations would be 20M UNI (10M R1 + 10M R2) - Delegation Cap: 2.5M

The largest delegation any delegate may receive after having their prior delegation amount boosted by a TDR2 is 2.5M UNI. Meaning if a delegate has 1.5M UNI in delegations today, the most they could receive from TDR2 would be 1M UNI. - Expiration: Non-Explicit

While revocations should be possible due to lack of individual delegate participation, expirations lack flexibility and risk putting the DAO back into a quorum deficit. Further enforceability is difficult given TD recipients could simply vote to extend expiration windows. - Selection Process: Election Process with Objective Criterion for Nomination Eligibility

Important Note:

It is important to note that it is presently too early to assess the exact framework of a treasury delegation program as we await A16Z’s ultimate decision regarding redelegations, or lack thereof. The UAC will revert to this thread in ~3 weeks time with more clarity around our suggestions around program structure. The UAC is monitoring the situation, and will advise accordingly