Update - August 31, 2025

This proposal was posted onchain Sunday, August 31 2025 and will be live for voting on Tuesday, September 2 2025 in the morning EST. You can access the vote here.

The 30-day TWAP used to calculate the amount of UNI to transfer to Cowrie (7198) and to DUNI’s multisig (1,583,493) is $10.42.

The proposal was generated with this script, and makes use of a custom abstraction on the Ethereum Attestation Service contracts, detailed here. By midafternoon EST on Sunday, August 31 you can download the artifact linked in the latest run of the Seatbelt testing suite here to confirm the output of this proposal if it is successful.

Thanks to Scopelift for their work on these contracts and help in preparing and testing this proposal.

Each Attestation references a content hash that defines the offchain contract being signed. To check the content hashes match the appropriate documents, you can drop each agreement into the hashing component on the EAS Tools page. Thanks to the EAS team for building an easily extensible public good!

Association Agreement

- Agreement anchor: 0xe4b69D68341abBdd08023cD39bAe9a0D5360B6c1

- Party A: Uniswap Timelock @ 0x1a9C8182C09F50C8318d769245beA52c32BE35BC

- Party B: address(0)

- Content hash: 0xe8c79f54b28f0f008fc23ae671265b2c915d0c4328733162967f85578ea36748

- Agreement: Linked here

Administrator Agreement

- Agreement anchor: 0x22005982Ae6BD2E90167F34a4604FfD59AFa7E9d

- Party A: Uniswap Timelock @ 0x1a9C8182C09F50C8318d769245beA52c32BE35BC

- Party B: Cowrie @ 0x96855185279B526D7ad7e4A21B3f8d4f8Ca859da

- Content hash: 0x1e9a075250e3bb62dec90c499ff00a8def24f4e9be7984daf11936d57dca2f76

- Agreement: Linked here

Ministerial Agent Agreement

- Agreement anchor: 0x5267b6C862D3e8826717Eba42936e310425C02FA

- Party A: Uniswap Timelock @ 0x1a9C8182C09F50C8318d769245beA52c32BE35BC

- Party B: UF @ 0xe571dC7A558bb6D68FfE264c3d7BB98B0C6C73fC

- Content hash: 0x6dd5ee280fe12c69425c9d4b137d8f64578f5e67b76904e994687644f7511516

- Agreement: Linked here

Summary

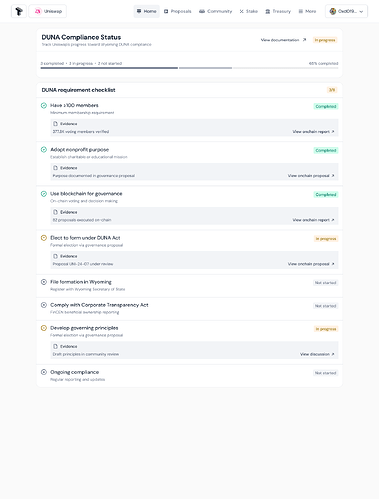

The Uniswap Foundation (“UF”) proposes that Uniswap Governance adopt a Wyoming-registered Decentralized Unincorporated Nonprofit Association (“DUNA”) as the legal structure for the Uniswap Governance Protocol. This new legal entity, called “DUNI”, will be purpose-built to preserve Uniswap’s decentralized governance structure while enabling engagement with the offchain world (e.g., entering into contracts, retaining service providers, and fulfilling any potential regulatory and tax responsibilities).

If adopted, DUNI will be a legal entity for Uniswap Governance that recognizes the binding validity of onchain Governance Proposals with the intention of providing certainty regarding its legal structure and intended liability protections for members of DUNI. Adopting DUNI does not, in any way, alter the Uniswap Protocol, the UNI token, or the core mechanics of onchain governance. Rather, it represents a significant step in equipping Uniswap Governance for the future.

Importantly, establishing Uniswap Governance as a DUNA would bolster critical limited liability protections for governance participants. This step is intended to protect governance participants from potential personal exposure to possible legal or tax liabilities stemming from the collective action taken by Uniswap Governance. This is a critical step in de-risking engagement in Uniswap Governance without compromising decentralization.

Background & Motivation

In the Uniswap Unleashed roadmap, we described a vision for evolving Uniswap Governance. In this vision, Governance can turn on the protocol fee, fund innovation, form partnerships, and navigate legal obligations with confidence. While onchain governance is integral to Uniswap’s credible neutrality, it has historically lacked the corresponding infrastructure for basic offchain coordination and formalized protection for its collective actions. To execute on our vision, we need something more.

To that end, over the past two years, the Uniswap Foundation has explored options for establishing a legal structure that is intended to:

- Provide more clarity regarding liability protection for Uniswap Governance participants;

- Maintain the primary authority of the Uniswap Governance protocol; and

- Enable execution of offchain operations without introducing centralized points of control.

After significant research, legal consultation, and community engagement, the Wyoming DUNA (passed into law in 2024) emerged as a credibly neutral and transparent option. It has been explicitly designed for decentralized protocol governance systems to gain legal legitimacy without compromising their core ethos.

In our research, we have worked closely with a firm called Cowrie, founded by David Kerr. Based in Cheyenne, Wyoming, Cowrie is composed of a team of regulatory and technical experts that provides legal, financial, and administrative support to decentralized protocols. David was instrumental in writing Wyoming’s DUNA statute, and has worked directly with legislators to educate them on the intricacies of the DUNA, what it enables DAOs to accomplish, what DAOs are, why decentralization is important, etc. Cowrie’s role in the context of DUNI is to act as an Administrator of DUNI - facilitating regulatory and tax compliance, tax filings, informational reporting, and operational infrastructure within the constructs of its authorizations.

Specification

If this proposal passes, the resulting onchain transaction will adopt a DUNA for Uniswap Governance. Specifically, it will:

- Ratify the DUNA’s Association Agreement establishing the rules of DUNI;

- Execute a Ministerial Agent Agreement with the Uniswap Foundation; and

- Execute an Administrator Agreement with Cowrie - Administrator Services;

- This includes the execution of a separate Administrator Agreement with David Kerr (CEO of Cowrie) for specific authorizations.

Additionally, the transaction will execute two transfers of UNI from the treasury, specifically:

- $16.5m worth of UNI to a DUNI-owned wallet to prefund a legal defense budget and a tax compliance budget;

- $75k worth of UNI to Cowrie for their services as compliance administrator.

We’ll discuss each of these authorizations and transactions below and provide links to supporting documentation at the end of this post.

Association Agreement Overview

An Association Agreement is the foundational charter that governs the relationship among members of a DUNA. At its core, it functions as a mutual contract: defining who may participate, what rights and obligations each member holds, and how collective decisions are made and enforced. Unlike traditional corporate formation documents, DUNI’s Association Agreement is intentionally designed to align with Uniswap Governance’s onchain infrastructure, enabling proposals, votes, and outcomes to be transparently executed and recorded via smart contracts.

Please find a detailed summary of the Association Agreement here, and the full text of the Association Agreement here.

Ministerial Agent Agreement Overview

Upon the passing of this proposal, the UF will serve as the initial Ministerial Agent of DUNI. This is a limited, clearly-defined role established in the Association Agreement and Ministerial Agent Agreement to facilitate administrative tasks on behalf of DUNI without introducing centralized control or discretionary authority.

In this context, a Ministerial Agent is an entity authorized to carry out specific operational functions that implement the decisions of Uniswap Governance. These functions are procedural, not discretionary. The Ministerial Agent cannot independently set policy, interpret proposals, or act outside the explicit bounds of governance-approved instructions.

Examples of ministerial actions include:

- Executing documents or submitting filings on behalf of DUNI as instructed by Governance

- Appointing and coordinating with third-party service providers as approved by Governance (e.g., lawyers, auditors and tax administrators, banks, and the like)

- Transmitting Governance-approved funding, payments, or grants

- Communicating and publishing updates related to administrative operations

Importantly, the Ministerial Agent has no power to override or reinterpret Governance decisions. All authority originates from Uniswap Governance and is constrained by the Association Agreement and Ministerial Agent Agreement. This structure ensures Uniswap Governance can interface with the offchain world when necessary while preserving decentralization and minimizing reliance on any single actor.

The Ministerial Agent Agreement can be found here.

Administrator Agreement Overview

The Administrator Agreements with Cowrie - Administrator Services and David Kerr empower them to act as administrators of the DUNI to execute only those duties explicitly approved by Uniswap Governance. Administrators do not have any discretionary policymaking authority or centralized control. DUNI will engage Cowrie as its Administrator for essential compliance, financial, and reporting tasks on behalf of DUNI.

DUNI will engage with David Kerr, in his individual capacity, for the purposes of reviewing and signing any applicable tax returns as a member of DUNI. Kerr possesses the requisite experience and qualifications to perform these duties through his 10+ years’ experience preparing and reviewing tax returns, numerous advanced degrees, and certifications.

Examples of administrator actions that Cowrie may undertake include:

- Preparing and filing all DUNI tax returns (federal and state) and securing an EIN

- Drafting quarterly financial statements and delivering membership updates on financials and tax filings

- Managing DUNI’s financial accounts for dispositions, expenses, and compliance reserves

- Performing registered-agent duties (annual filings, service-of-process) and liaising with the IRS on current and prior-period filings

Examples of administrator actions that David Kerr may undertake include:

- Reviewing and signing tax returns as a member of the DUNA.

Protections and limits:

- Administrators are indemnified for all good-faith performance, but are not shielded against willful misconduct or gross negligence.

- The Administrator Agreements run through the filing of the 2026 tax return, at which time extension of services would need to be authorized through a governance proposal. These authorizations can also be revoked through a governance proposal at any time.

- All compensation to Cowrie - Administrator Services (a one-time UNI token award) and expense reimbursements must flow through governance proposals.

- David Kerr is not directly compensated for his administrator role. Rather, a $1,000 donation will be made by DUNI to various WY charities matched by Cowrie for every year of filed tax returns.

By codifying these provisions, the Administrator Agreements ensure DUNI can meet its legal, tax, and financial obligations while preserving Uniswap Governance’s exclusive authority over policy, budgets, and the scope of work.

The Administrator Agreement can be found here.

Fund Request Overview

As part of this proposal we are requesting an allocation of funds from the DAO Treasury sufficient to:

- cover legal expenses for the DUNA formation, which may include the payment of any taxes due to fully and finally settle past tax obligations (if any);

- form a legal defense budget to pay for counsel to advise on DUNI-related legal matters, as well as pay for defense of any lawsuits against DUNI that may arise; and

- pay any income taxes or capital gains incurred in connection with liquidating UNI for 1. and 2.

The total amount being requested is $16.5m. UNI amounts will be determined based on a 30-day TWAP calculated on the day the proposal goes live onchain.

As Ministerial Agent, the UF will liquidate this UNI to fund DUNI’s dollar-denominated expenses. Our strategy in doing so will be designed to minimize market impact.

Tax Considerations Overview

Over the past year, the UF, along with our outside counsel and tax advisors, has conducted a thorough review of the historical tax posture of Uniswap Governance. Based on that diligence, we have developed what we believe is a clear and prudent approach to seek to ensure full tax compliance, paving the way for a smooth transition to the DUNA structure.

Uniswap Governance has never made an election with the IRS to be treated as a corporation for federal tax purposes. The proposed strategy is to engage with the IRS and settle any potential prior period tax obligations arising from this prior approach.

Opinions vary as to the current tax obligations for the Uniswap DAO, but allowing DUNI to move forward unencumbered by any past uncertainty in tax treatment will almost certainly incur U.S. tax obligations. We believe resolving any such ambiguity by paying any such past tax obligations represents the simplest and cleanest path forward for DUNI. While there cannot be significant disclosure of the tax estimates until resolution has been achieved, it is expected that all tax obligations for prior years will be under $10 million, inclusive of interest and penalties calculated resulting from the approach. This proposal includes the empowerment of the UF to appoint outside tax counsel and Cowrie to use its business judgment to resolve any such past tax issues with the IRS, and further authorizes Cowrie (through David Kerr, where necessary under applicable law and regulations) and outside tax counsel to negotiate and agree with the IRS, and ultimately pay such amounts where necessary to resolve any past tax liability. Upon resolution with the IRS, all relevant prior period workpapers will be included as part of Cowrie’s financial statement and tax return presentation.

Cowrie, as the designated administrator of DUNI, will be responsible for interfacing with the IRS and executing all tax filings on behalf of DUNI. The UF, as ministerial agent, will be responsible for retaining tax counsel (where appropriate) to represent DUNI before the IRS.

Supporting Documents

DUNI’s corporate documentation, summaries, agreements, and a comprehensive list of frequently asked questions can be found on the UF’s DUNI mini-site here. The documentation includes:

- DUNA Association Agreement: Establishes the rules, structure, and operational framework for DUNI. Outlines member rights, responsibilities, and management processes.

- Summary of DUNA Association Agreement: brief breakdown of each article in the Association Agreement.

- Administrator Agreement: Authorizes Cowrie for certain administrative tasks related to DUNI.

- Administrator Agreement: Authorizes David Kerr to review and sign tax returns as a member of DUNI.

- Ministerial Agent Agreement: Authorizes the Uniswap Foundation as the initial Ministerial Agent of DUNI.

Next Steps

The UF will be engaging with delegates over the course of this proposal, starting tomorrow (August 12, 2025) on the regularly-scheduled Uniswap Governance community call.

- Community discussion and feedback (Week of August 11, 2025)

- Snapshot vote (Week of August 18 or 25, 2025)

- Onchain vote (Following Snapshot)

This proposal marks a turning point for Uniswap Governance. If passed, it provides the tools to govern with clarity, act with autonomy, and grow with confidence. We invite the community to review the documentation, ask questions, and help shape this important step forward.