GLI 1 Interim Assessment and Next Steps: Quorum (Part 2)

Proposal Summary (Incentivized Delegation Vaults):

Incentivized Delegation Vaults: Multiple delegates recognized that it is not healthy for the governance ecosystem if the entirety of the votable supply is sustained by treasury delegations alone. As such, encouraging community delegations is essential. The most direct and intuitive approach is to incentivize participation. IDVs offer a low-touch, plug-and-play approach to facilitate this. Each eligible delegate will receive their own IDV. Delegators to each vault will receive emissions passively once delegated. The objective of IDVs is to, at a minimum, close the 9M UNI shortfall.

Vault Structure:

Unique Vaults for Every Delegate: Each eligible delegate will receive their own branded vault. Eligibility extends to:

-

Treasury Delegation Candidates: Any delegate who qualifies for treasury delegations (regardless of whether they ultimately receive treasury delegations).

-

Delegate Compensation Applicants: Any delegate who applied for the Delegate Reward Initiative cycle 4.

Once created, these vaults will allow UNI token holders to earn reward emissions for delegating voting power to any branded delegate vault. No cost or obligations will be incurred by the delegates.

Application Content: Applicants will need to provide

- Brand Kit: Desired delegate brand name and a PNG or SVG logo to allow for the branding of their vault.

- Delegate Address: The wallet address to which they would like delegation to accrue

User Experience: IDVs simply track delegation activity on-chain, specifically who delegated to whom and how much, and emit weekly airdropped rewards to participants in exchange for delegating to eligible delegates. There is no transfer of assets, depositing or contract interactions necessary for claims.

Flat Rate Emissions: A flat rate emission will be provided to depositors into any vault.

- Ex. Assuming an APR of 2%, if there are 10 delegate vaults, with 1,000 UNI delegates across them in any distribution, each UNI delegated will earn 0.02 UNI per year, regardless of which vault it is held in.

Security: Tokens never leave the users’ wallets. Delegation through IDVs is fully non-custodial. Users maintain complete control over their assets and are rewarded solely for delegating, not for transferring or locking tokens. Delegation is executed via a signature-based function call on the Uniswap token contract.

Application Process: There will be an additional vault application thread where eligible applicants will be able to express their interest.

Configuration:

-

Target Delegations: 9,000,000 UNI

-

Starting APR: 2%

-

APR Rationale: Assuming Treasury Delegations pass, the shortfall in delegated UNI is projected at ~9M UNI. At present, UNI has few, if any, single-sided, low-risk yield opportunities. A 2% APR is therefore considered sufficient to incentivize participation without excessive emissions.

- At 2%, the one-year value of a single delegated UNI is 0.02 UNI per annum.

- Note: Because delegations will not materialize immediately at full scale, actual emissions may grow gradually, extending the budget’s effective duration beyond one year.

-

-

KPI: Emissions operate on a flat-rate model: every UNI emitted definitionally secures the exact amount of delegation value the DAO seeks. This design and commitment to flat vs variable APR eliminates the risk of “overspend” or “underspend”: If more UNI is delegated, emissions scale up. If less UNI is delegated, less UNI is emitted. The sole KPI for program management is therefore to maintain an average APR at the DAO-approved target rate (e.g., 2%). This is achieved through straightforward accounting and strict adherence to the DAO mandate. In short, performance to emissions is guaranteed by design; the program succeeds whenever the agreed APR is consistently maintained.

-

Budget: 18,200 UNI

-

Initial Build: 5,000 UNI – A one-time allocation that covers the full build and instantiation of the product. This is released by the UAC at the point at which the product is functioning as noted by the launch of the first, or first batch, of delegate-branded IDVs.

-

Year 1 Development and 2 Years of Maintenance: 13,200 UNI provides for one year of ongoing development and maintenance. Event Horizon will guarantee active development during the first 12 months. This may include as reasonable, the incorporation of on-chain delegate metrics and requirements, integrations with approved third-party products, adjustments to the emissions model, other DAO-requested improvements deemed beneficial. Event Horizon further commits to up to an additional 12 months of general product operation and maintenance beyond the 1 year payment term.

-

Note: The Event Horizon team aims to serve as a transparent, consistent, and reliable builder for the Uniswap community alongside other recognized names such as Oku for years to come. In that spirit, we approached valuation in an effort to both allow for operational viability and continued future work/value provision for the DAO and to be respectful and reasonable in what we ask of the DAO. Our reasoning landed as follows:

-

From the DAO’s perspective, there is clear value in expanding the votable supply. This is abundantly evident by the current >$200m quorum deficit. But it also strengthens Uniswap’s governance by reducing vulnerability and prevents future bottlenecks in decision-making.

-

From the individual delegate’s perspective, IDVs create tangible value by supporting their community involvement and in directly expanding their delegation through incentives.

-

To ground the valuation of governance participation, we looked at existing precedent: the delegate reward initiative. At current UNI prices, each compensated delegate receives ~600 UNI/month, while the average compensated delegate maintains ~1M UNI in delegations. In other words, consistent participation of ~1M UNI is currently valued by the DRI at ~600 UNI/month.

-

The IDV program is designed to mobilize up to 9M UNI. If even 10% of this target is reached (900K UNI), the mobilized voting power is equivalent to that of a compensated delegate presently valued at 600 UNI per month. At full capacity, IDVs nearly match the voting power of every compensated delegate combine, which currently represents a cumulative value of ~9,000 UNI per month.

-

Importantly, this added voting power also improves the cost efficiency of the reward initiative itself, since every compensated delegate will be eligible for their own vault and therefore become the direct recipients of the delegations driven by IDVs. The same delegates, being paid the same amount from DRI, now mobilizing a much more impactful benefit to the DAO.

-

The entire program’s total cost nets to ~750 UNI/month, or approximately the cost of a single compensated delegate. This is factoring in not just mobilized voting power but also upfront build costs, benefits to individual delegates, and ongoing maintenance and evolution.

-

-

-

Treasury Earmarked for Possible Emissions: 180,000 UNI

- The UAC will custody 180,000 UNI for potential future emissions. This amount represents the maximum reserve required to support up to 9M UNI delegated for one year at a 2% APR.

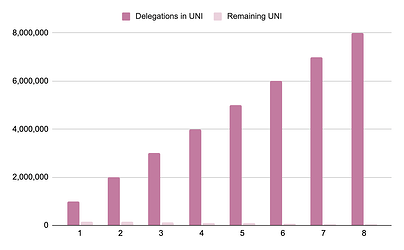

Proportional Scale

Re-Scaled

-

Key points on Emissions:

-

Flat-Rate Emissions: Each UNI emitted has a consistent marginal value. For example, at a 2% APR, every 1 UNI emitted secures 50 UNI in delegation for at least one year.

-

Not a Committed Expense: The 180,000 UNI is an earmark, not a guaranteed outlay. Actual emissions will depend on delegation uptake, which is expected to ramp gradually rather than begin at full scale. The UAC only emits an amount of UNI directly proportional to the amount of value (in the form of delegations) that the delegates, and thereby the DAO, have gained through the vaults. As depicted above, it is a direct trade-off between delegations and UNI emissions at the exact value exchange rate determined and managed by the DAO.

-

Conservative Buffer: While it is unlikely the full 9M will be delegated immediately, holding the full earmark avoids the need for a risky “top-up” proposal under sub-quorum conditions.

-

Non-Dilutive: It is important to distinguish these emissions from other programs, such as LP incentives, in that the emissions are exclusively dedicated to UNI token holders. Any token holder who helps secure the DAO receives their share of emissions. As such, dilution is fully avoidable. And, contextualized at scale, even at its fullest emission rate, it represents ~0.034% in completely avoidable dilution annually.

-

DAO Flexibility: Any unused portion remains in UAC custody and ultimately under DAO control, to be reallocated or repurposed as the community decides. After the initial 12 months, the UAC will begin a discussion and eventual vote to determine how any remaining emissions amount should be utilized, be it continued incentive rounds, return to treasury, or otherwise.

-

-

Eligible Delegates:

-

Path 1 Treasury Delegation Application: All delegates eligible for the Treasury Delegation program will automatically be eligible to have a vault created and funded for them, regardless of whether or how much delegation they received during the treasury delegation round.

-

Path 2 – Delegate Compensation Applicants: Anyone who applied for delegate compensation will be considered eligible.

-

-

UI:

To begin, Event Horizon will host the initial IDV UI. That said, after initial instantiation, any DAO-approved vendor will be eligible to host a white labeled instance of the vaults. -

APR Management:

-

Baseline Rate: The program will target an average APR of 2%.

-

Governance Oversight: The UAC may propose to amend the APR cap at its discretion. Any recommendation to increase the APR cap must be taken to a Snapshot vote.

-

APR Ceiling: No rate shall exceed 10% APR at any time without Snapshot approval.

-

Reporting: The UAC will provide monthly reporting on the rate of emissions, delegation amounts, and other relevant information during the community calls.

-

APR Adjustments: The UAC may adjust the APR within the program to optimize participation (e.g., a front-loaded APR schedule to encourage early delegations). All adjustments will be posted publicly under the program’s forum thread and will require a customary Snapshot vote. No adjustment shall exceed 10% APR for any duration without Snapshot approval.

-

Custody of Funds: The UAC will custody funds and disperse them for emissions as needed.