This proposal is brought to the DAO by the Uniswap Accountability Committee (UAC) & Uniswap Growth Program—in collaboration with Plasma.

This forum post intends to accomplish two purposes:

-

Publicly signal the UAC’s intent to eventually allocate $250k from the incentives discretionary budget to the Plasma deployment, along with a detailed rationale for the allocation.

-

Collaborate with Plasma to request an additional $250k from the treasury via the customary governance path (RFC, Snapshot, Onchain vote).

The incentives discretionary budget was created in December 2024. Since its inception, it has not been utilized due to the stringent bar required for deployment: unanimous agreement among all five UAC members. These funds are reserved exclusively for incentive matching in exceptional circumstances. After reviewing multiple inbound requests over the past several months, the Plasma proposal stands out as the most compelling.

Plasma intends to allocate up to $5M in incentives over 6 months. The exact allocation will be dependent on the XPL price. Their team has agreed to put in place a floor distribution amount of $500k per month to accommodate for XPL fluctuations, meaning the total minimum allocation will be at least $3M to allow them a degree of breathing room based on FDV—the XPL amount is fixed. Each monthly tranche must be at least equivalent to $500k for Uniswap to match its corresponding allocation.

Due to pending legal considerations around newly approved incentive programs, the UAC is unable to allocate the discretionary budget upon Plasma mainnet launch. We hope to have more updates here soon.

In the meantime, Plasma has agreed to begin distributing their part of the incentives from launch, ensuring momentum from day-one. Incentives went live on September 25th. Once/if the UAC is able to release its discretionary funds, Uniswap’s allocation will “catch up” to the agreed amount. Since the campaign timeline is 6 months, the UAC will compress the $250k discretionary tranche over whatever time that may be lost. For example, if it takes a month to finalize the stated legal matter, instead of allocating $41.6k over 6 months, we’ll do $50k over 5, summing to $250k overall. The one month delay is a hypothetical—exacts are yet to be determined.

Additionally, if the second tranche of $250k is approved by the DAO, we will add that on top of the discretionary allocation. These two tranches are purposefully present due to the uncertainty and further delays that may be associated with following the full governance path. In the “Allocation Details” section below, we outline the tentative pools and corresponding allocation percentages across pairs. Plasma’s and Uniswap’s allocations are not identical. Uniswap will have a higher focus on ETH and stable pools.

Below is our detailed rationale for this allocation:

Uniswap’s Foray into Stablecoin Chains

Guiding Question: How does Uniswap position itself to benefit from stablecoin growth and adoption?

Over the past handful of months, we’ve seen numerous announcements around stablecoin-focused chains (like Plasma, Arc, Stable, and Tempo). This isn’t coincidental. Mid-2025 marks the first time global regulations have shifted from “grey area” uncertainty to clear, supportive frameworks, reducing compliance risks and inviting institutions to build around stablecoins. Key drivers include U.S. legislation like the GENIUS Act, alongside the EU’s MiCA rollout, collectively unlocking broad crypto adoption.

Stablecoin txns have also encroached on fintech platforms and traditional ACH rails, demonstrating a clear market fit across jurisdictions and geographies:

Source: Artemis

Naturally, Uniswap will benefit from the second-order effects of stablecoin adoption on networks that it presently presides on. After all, USDC and USDT hold the top two spots for trading volume on mainnet. The more stablecoins are used globally, the more trading and swapping of those stablecoins, and assets paired with them, will occur on DEXs. Volume on Eth today relies overwhelmingly on stablecoins; ignoring a chain like Plasma could mean losing that volume to competitors on the new rails. It’s not simply about preserving market share on existing chains.

Source: Uniswap.org

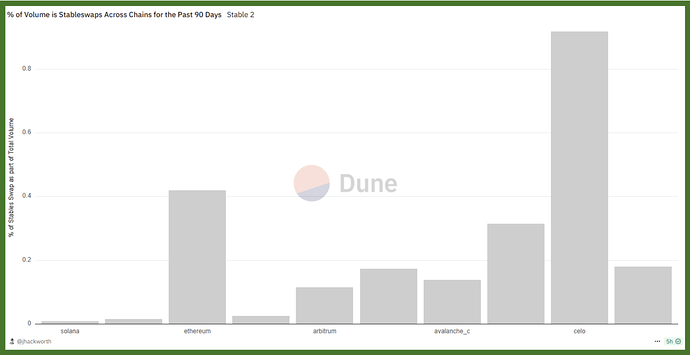

If we predict that much of this volume is anticipated to migrate to stablecoin-focused chains, then Uniswap must consider expanding into these new environments. The most recent instance of the DAO approving an incentive package primarily focused on stablecoins was with Celo, with currency pairs like USDT/USDC, USDT/cUSD, USDT/cEUR, USDT/PUSO, USDT/cREAL, etc. We are now on month 6/6 of this campaign, and Uniswap presently maintains an >85% DEX marketshare on the L2.

Source: Dune (jhackworth)

But beyond Eth and Celo, Tron has so far been the exemplar for demonstrating that a stablecoin chain can succeed. Uniswap has had multiple conversations with the Tron team in the past. However, none of those interactions resulted in a deployment or any other collaboration yet. The primary motive behind these conversations was precisely to settle more stablecoin swaps. Plasma now presents this opportunity.

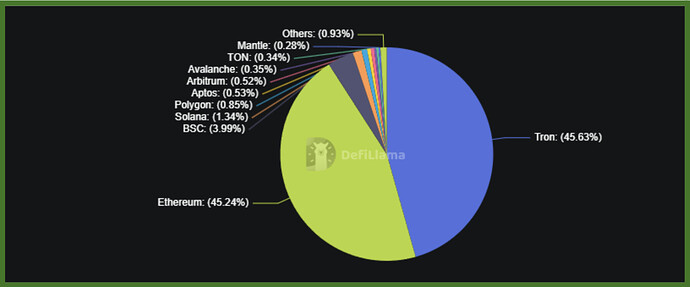

As of September, over 45% of the total USDT supply is present on Tron, equivalent to ~$170B.

Source: DefiLlama

In the past 24 hours, USDT txn volume on Tron sits at parity with that of Eth mainnet, at approximately $11B. However, due to the expensive nature of Ethereum, the txn count on Tron far surpasses that of mainnet, nearly by a factor of 6 (source: Artemis). Tron itself isn’t the cheapest chain either. Just a couple of days ago, the average USDT transfer fee amounted to 2.7 TRX, which was nearly $1. Relative to Plasma’s zero-fee transfers for USDT, Tron suddenly loses much of its value proposition as the “cheap” stablecoin transfer chain. Another important note is that various centralization factors with Tron have been persistent, along with a high degree of preference for Justin Sun-branded protocols like SUNSwap, making it difficult for Uniswap to compete in such an environment. It’s increasingly important to ensure target chain buy-in when deploying v3.

In Plasma’s case, the v3 contracts for this deployment will underpin the Plasma-branded swapping front-end. This presents a clear distribution channel. White-labeled trading front-ends, with contract ownership being held by the DAO, are a key direction for Uniswap to propel growth without necessary reliance on the Uniswap Labs front-end. This DAO-to-chain collaboration allows for Uniswap to grow in upcoming environments and establish a stake in growing narratives like stablecoins. As for LPs and traders who prefer a more intricate interface, Oku.trade will support this functionality on day-one (you can swap and LP now). The v3 swapping interface on the Plasma-branded app will go live very soon after launch day.

Plasma Rewards Dashboard

Emerging Ecosystem of Stablecoin Chains

Source: Messari

There is the question of which stablecoin chain Uniswap should mostly focus on, as every day we seem to hear a new announcement. Of course, it will be important to track how each one of the stablecoin chains performs over time. So far, of these chains, Plasma has demonstrated the strongest traction and commitments from well-known protocols and partners—not to mention it will inherit robust security by publishing block roots to Bitcoin. They have also gone to market sooner than the other chains. For instance, Arc, Circle’s planned chain, does not have a testnet yet. The Plasma team has further secured large amounts of seed liquidity to propel the ecosystem at launch, ensuring strong momentum:

\

Most importantly, Tether seems to have all the incentive to see Plasma succeed. The entire foundation of the chain is built on the LayerZero omni-chain version of USDT, USDT0. Both Tron and Ethereum are separate ecosystems that benefit massively from USDT’s presence, but as mentioned before, they run into scaling and cost issues. It would seem logical for Tether to invest in a chain that both aligns their financial incentives and opens the door for higher stablecoin velocity.

To enable this value proposition, the architecture of Plasma is divided into a two-block system, where one type of execution is solely meant for USDT transfers at zero cost, while the other EVM-based execution pathway does incur fees. This means that Plasma, in order to capture any economic value, must see dapps flourish as well. Free stablecoin transfers, therefore, become a point of parity for these types of chains, thereby outcompeting Ethereum and Tron as they both charge fees for sending USDT. In other words, every time someone swaps or LPs using Uniswap, Plasma benefits at the marginal level, but mere USDT remittances, for example, do not provide a similar benefit. A robust DeFi ecosystem is how the chain sustains itself in the long-term.

Source: Delphi Digital

DEX Competition

Uniswap will, of course, be competing with other trading venues like Curve and Fluid, both of which are day-one launch partners on Plasma. This will especially be the case for stable-stable pairs. As seen below, Fluid in particular has been increasing its market share of stable-stable swaps on mainnet, now accommodating 34% of the volume, while Uniswap stands at ~36% of the stable pair volume. Again, Uni v3 will have a fighting chance here as well due to the Plasma-branded front-end, while Fluid will solely rely on their own front-end.

Another reason why Uniswap on Eth mainnet attracts high stablecoin volume is due to liquidity depth. Trades made on mainnet tend to be less frequent but accommodate for much larger size. If Plasma is able to create a strong flywheel for bootstrapping liquidity, it attracts Ethereum whales. This, accompanied by a potential vampire attack on Tron’s USDT txn volume, creates a positive adoption spiral. Now you have both depth and high txn volume.

Source: Dune (jhackworth)

A differentiating factor for Uni v3, of course, is the CLMM architecture. Although a dapp like Curve may attract much of the stable pair liquidity, Uniswap is geared to facilitate much of the volatile pair activity. This is why a majority of the incentives, for example, are directed at the Plasma native token (XPL), paired with USD₮0, along with much of the UNI incentives going to wETH and weETH (Ether.fi’s value-accruing restaked ETH) pools. Plus, the second-order effects of a high-velocity stablecoin chain with deep liquidity mean that DeFi has a natural path to success on the chain. Due to the headaches with bridging, once a whale migrates to Plasma for stable txns, they may carry out their wETH txns on Plasma as well. Accordingly, volatile pairs are up for grabs if Uniswap launches and prioritizes growth immediately. This pattern incentivizes other asset issuers to launch their tokens on the chain as well:

Using incentives to bootstrap pools for these teams allows Uniswap to capture this market from day one.

Allocation Details

Below is the allocation that Plasma will begin abiding by upon launch:

The initial batch of incentives is live as of September 25, accessible through Plasma’s rewards site, powered by Merkl:

Once able, Uniswap will begin abiding by the following allocation:

Discretionary Budget $250k UNI Incentives (Tranche 1):

-

XPL/USD₮0 - 20% of incentives

-

USDe/USD₮0 - 25% of incentives

-

ETH/USD₮0 - 25% of incentives

-

weETH/USD₮0 - 20% of incentives

-

XAUT/USD₮0 - 10% of incentives

DAO-Approved $250k UNI Incentives (Tranche 2):

-

XPL/USD₮0 - 20% of incentives

-

USDe/USD₮0 - 25% of incentives

-

ETH/USD₮0 - 25% of incentives

-

weETH/USD₮0 - 20% of incentives

-

XAUT/USD₮0 - 10% of incentives

Budgeting

The framework for determining the discretionary budget is as follows:

-

Step 1: Multiply the Incentives Account balance by 1.5× to establish the reserve threshold.

-

Step 2: Subtract this threshold from the adjusted balance to determine the discretionary budget.

-

Step 3: Any allocations reduce both the discretionary budget and the effective surplus accordingly.

More details can be found here.

When the Plasma allocation is executed, the exact figures will be updated in this forum thread based on the prevailing UNI token price at that time. The principles outlined above will remain unchanged, and the community will be provided with transparent updates on balances, allocations, and remaining discretionary capacity.

For transparency, the Growth Program will also provide updates to the DAO as incentives start and keep the community informed with TVL and usage metrics. Initial updates will solely include Plasma’s allocations.